- 1. Profession Tax Enrollment Certificate (PTEC) –

- 2. Profession Tax Registration Certificate (PTRC) –

Commencement & Applicability of Profession Tax Provisions in Maharashtra

The act is applicable to whole state of Maharashtra and has came into effect from 1 st April 1975.

The act is applicable to all class of establishments whether, Proprietary, Partnership, Company, Limited Liability Partnership (LLP), Trust, Society, Club or Association etc.

Definitions under Maharashtra State Tax on Professions, Traders Callings and Employments Act 1975

1. Employee means a person employed on salary and wages.

2. Employer in relation to employee earning salary or wages means person or officer who is responsible for disbursement of such salary and wages.

3. Person means all class of establishments whether, Proprietary, Partnership, Company, Limited Liability Partnership (LLP), Trust, Society, Club or Association but does not include any person who earns on casual basis.

4. Salary and Wages means basic wages, dearness allowance and all other emoluments including perquisites and profits I lieu of salary received by any person on regular basis except bonus and gratuity.

Registrations under Maharashtra State Tax on Professions, Traders Callings and Employments Act 1975

Following two certificates are required to be obtained under the act,

1. Profession Tax Enrollment Certificate (PTEC) –

This certificate should be obtained by every person except firms (whether registered under Partnership Act 1932 or not) and Hindu Undivided Family (HUF) engaged actively or otherwise in any profession, trade callings or employment and falling under any of the classes mentioned in the schedule I of the act and shall be liable to pay to the State Government, tax as per the rates mentioned against the class of such persons mentioned in the said schedule.

2. Profession Tax Registration Certificate (PTRC) –

This certificate should be obtained by every person including firms and HUF, having employees.

There is no minimum requirement of employment strength to obtain this certificate. This certificate should be obtained, even if a single employee is enrolled.

An establishment having employees should obtain both Enrollment as well as Registration Certificates except for Partnership Firms.

For Partnership Firms, each partner should obtain the Enrollment Certificate and the firm should obtain Registration Certificate.

Present Slabs Rates of Profession Tax:

1. Profession Tax Enrollment Certificate – Rs.2500/- every year

2. Profession Tax Registration Certificate –

For Male Employees,

- Drawing Gross Salary less than Rs.7500/- — NIL

- Gross Salary Rs.7501/- to Rs.10,000/- — Rs.175/-

- Gross Salary Rs.10,001/- and above — Rs.200/- (Rs.300 in month of February )

For Female Employees,

- Drawing Gross Salary less than Rs.10,000/- — NIL

- Gross Salary Rs.10,001/- and above — Rs.200/- (Rs.300 in month of February)

A maximum of Rs.2500/- is payable for the entire year and not more.

Further, a director, partner who is supposed to take enrollment certificate and pay Rs.2500/- is required to pay only once only and not for each company or firm in which he is a director and / or partner.

Same, for employees, if an employee is paying profession tax in one company he/she is not supposed to pay profession tax if he/she has a separate business or profession.

Compliance under Maharashtra State Tax on Professions, Traders Callings and Employments Act 1975 :

Every employer not having employees, should only pay annual PT charges of Rs.2500/- on or before 31 st March every year.

Every employer having employees should every month deduct the Profession Tax from the salaries of the employees as per the slab rates mentioned above and deposit with the Profession Tax department of the State of Maharashtra within 20 th of every month.

However, an employer whose Profession Tax liability for the entire year is below Rs.1,00,000/- has an option to pay the Profession Tax dues yearly instead of every month.

Employer whose profession tax liability is above Rs.1,00,000/- for the entire year should pay the dues monthly.

Every employer having employees should file an E-Return after payment of dues and the due dates are as under,

- PT liability below Rs.1,00,000/- – Single Return for entire year before 31 st March every year

- PT liability above Rs.1,00,000/- – Monthly Return before end of the month.

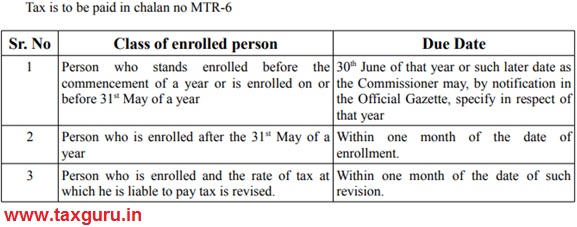

Due Dates under PT are as under:-

A) Profession Tax Enrollment Certificate (PTEC) holder

E-payment facility is available for PTEC holders.

B) Profession Tax Registration Certificate (PTRC) holder

How to make payment of Profession Tax:

The profession tax dues are supposed to be paid electronically only.

However, the method of payment is different. The same is as below,

– Normally, while making statutory payments, we select the month for which the salary is paid, however for profession tax payment, the next month of the contribution month should be selected.

Eg: For PT dues of salaries paid for month of January 2019, one should select the period February 2019. For February 2019, one should select period as March 2019, for March 2019, one should select the period April 2019 and so on.

This method is supposed to be followed for monthly payments only.

For yearly payment, one has to select the entire year April to March by default.

If in case, incorrect period is selected while making the payment, the profession tax portal will throw error at the time of filing the E-Returns and hence the said challans should be rectified by writing a request letter to the Profession Tax department.

How to File E-Returns under Maharashtra State Tax on Professions, Traders Callings and Employments Act 1975 :

Profession Tax Returns are supposed to be filed on profession tax portal www.mahagst.gov.in in Form no III-B.

Like method of payment, the method to fil return is also different as compared to other statutory returns. The same is as under,

1. For yearly return the period to be considered is from March to February

2. For monthly return, the period of return will be the next month of the contribution month and in table of employee details, the number of employees should be entered in the month for which return is filed.

Eg: for monthly return of January 2019, select period of return as February 2019 and enter the employee details in January column i.e. the month for which the return is filed.

Penal Provisions & Late Fees:

1. An employer in default shall be liable to pay simple interest at one and a quarter per cent of the amount of the tax payable for each month for the period, for which the tax remains unpaid.

2. If an enrolled person or a registered employer fails, without reasonable cause, to make payment of any amount of tax, within the required time or date as specified in the notice of demand, the prescribed authority may, after giving him a reasonable opportunity of being heard, impose upon him a penalty equal to ten per cent, of the amount of tax due.

3. Late fee for delay in filing return,

– Rs.200/- if return is filed within 30 days of the due date

– 1000/- if delay is more than 30 days of the due date

Exemptions: (Source Maharashtra Profession Tax portal)

Following classes of persons are exempt from payment of profession tax:

1. Members of armed forces of Union serving in the State;

2. Badli workers in the textile industry;

3. Any person suffering from a permanent physical disability (including blindness) specified in the rules, certified by a physician, a surgeon or an oculist, working in a Government hospital, which has the effect of reducing considerably such individual’s capacity for normal working or engaging in a gainful employment or occupation and also his parents or guardians;

4. Women exclusively engaged as agents under the Mahila Pradhan Kshetriya Bachat Yojana of Directorate of Small Savings;

5. Any person and parents or guardians of such person who is suffering from mental retardation specified in the rules, and, certified by a psychiatrist working in a Government hospital;

6. Persons having completed age of 65 years (w.e.f. 1-4-1995);

7. Parents or guardians of a child suffering from a physical disability mentioned in (3) above;

8. Partnership firms and HUFs (but each partner of a partnership firm and each coparcener of HUF are liable for enrolment, see entries 19 & 20 in Schedule–1).

9. Mathadi Kamgar (casual workers) [Cir. 12T dated 3-8-2011].

10. Professionals, covered by Entry 2 of the Schedule, up to one year of standing in the profession.

11. Armed members of Central Reserve Police Force to whom the Central Reserve Police Force Act, 1949 applies and the armed members of Border Security Force to whom the Border Security Force Act, 1968 applies, serving in the State of Maharashtra. (w.e.f. 1-4-2016)

Schedule I of the Act: (Source Maharashtra Profession Tax portal and Taxguru Website)

| Sr. No. | No. Class of Persons | Rate of tax ₹ |

| (1) | (2) | (3) |

| 1 | Salary and wage earners — Such persons whose monthly salaries or wages,— (From 01.04.2015) | |

| (a) do not exceed rupees 7,500; | NIL | |

| (b) (i) In case of male, exceed Rs. 7,500 but do not exceed rupees 10,000; | 175 per month | |

| (ii) In case of female, do not exceed Rs 10,000; | NIL | |

| (c) exceeds rupees 10,000 | 2,500 per annum to be paid in the following manner :- |

(a) rupees two hundred per month except for the month of February

C. (ii) trucks or buses for each such vehicle :

(a) Each partner of a firm (whether registered or not under the Indian Partnership Act, 1932), engaged in any profession, trade or calling.

Note : 1 Notwithstanding anything contained in this Schedule, where a person is covered by more than one entry of this Schedule, the highest rate of tax specified under any of those entries shall be applicable in his case.

Note : 2 For the purpose of Entry 8 of the Schedule, the Profession Tax shall be calculated on the basis of the “turnover of sales or purchases” of the previous year. If there is no previous year of such dealer, the rate of Profession Tax shall be Rs 2,000. The expression “turnover of Sales or purchases” shall have the same meaning as assigned to them, respectively, under the Maharashtra Value Added Tax Act, 2002 (Mah IX of 2005)

Disclaimer : The article is prepared on the basis of relevant provisions of the act and my practical knowledge of the subject. Care has been taken to produce the authentic and reliable information, however, the users are expected to refer the relevant existing provisions of the act. I therefore shall not be held responsible in any case for the consequences and outcome of use of the information.

(Republished with Amendments)